- About Us

- Products

- News

- Asset Allocation for Gen Z in Emerging Markets

- Phân Bổ Tài Sản Cho Gen Z Trong Emerging Markets

- Vietnam Gen Z: Early Income, Limited Wealth Growth?

- Gen Z Việt Nam: Thu Nhập Sớm Nhưng Tài Sản Không Tăng?

- Vietnam’s Emerging Markets: Wealth Management for Gen Z

- Thị Trường Mới Nổi Việt Nam: Wealth Management Cho Gen Z

- FTSE Upgrade 2026: ETF Inflows, Winning Stocks — Is Your Portfolio Positioned Correctly?

- Nâng hạng FTSE 2026: ETF Inflow, Winning Stocks & Danh mục của bạn đã đứng đúng vị trí?

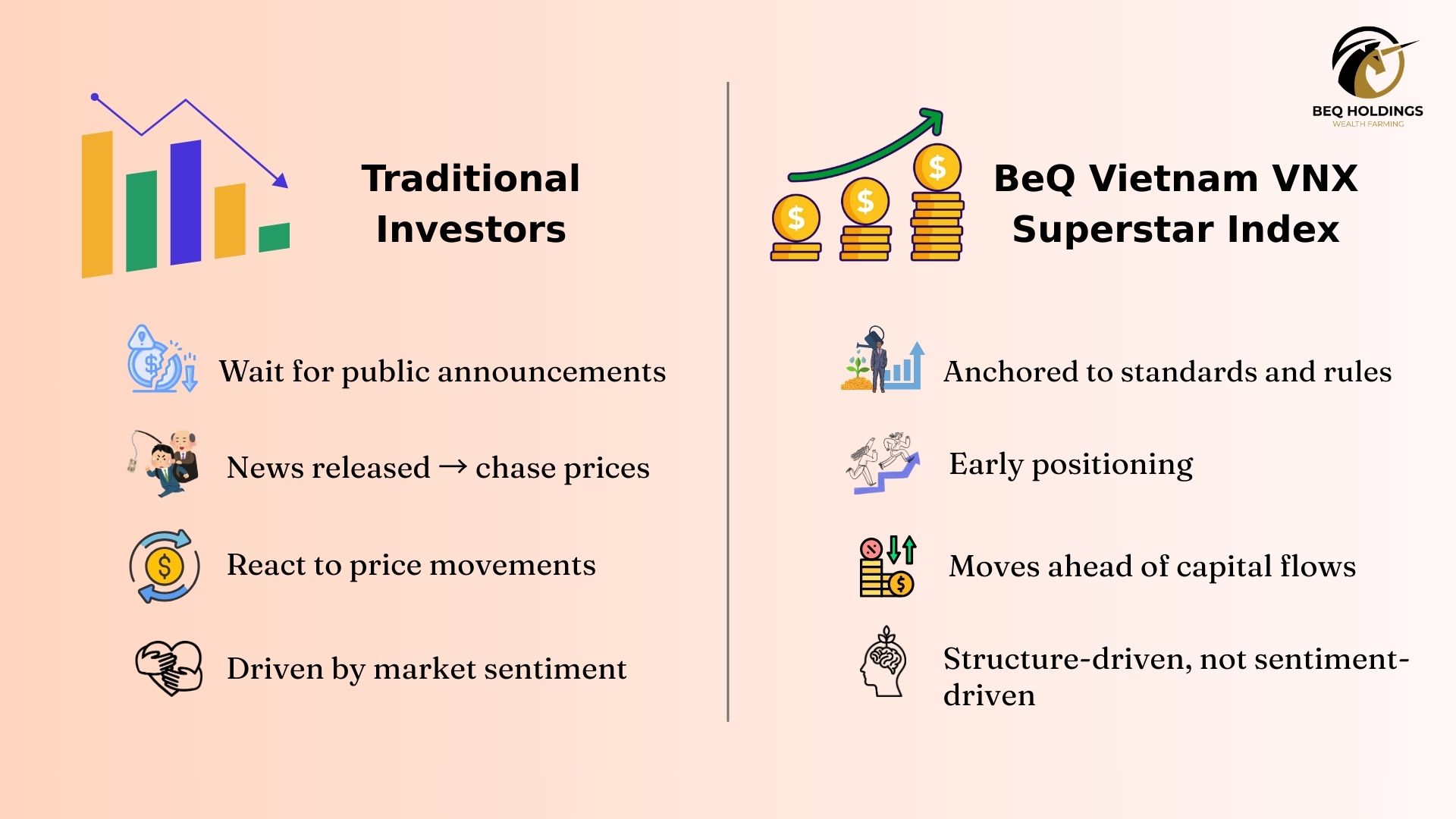

- BeQ Superstar Index: Why many investors still underperform despite correctly anticipating ETF flows

- BeQ Superstar Index: Vì sao nhiều nhà đầu tư vẫn thua dù đoán đúng dòng tiền ETF?

- BeQ Superstar Index: Why It Is Not Suitable for Every Investor

- BeQ Superstar Index: Vì sao không phải nhà đầu tư nào cũng nên theo đuổi?

- BeQ Superstar Index – A Safer Path as Global Capital Flows Shift

- BeQ Superstar Index: Lối tiếp cận an toàn khi FTSE Emerging Market tái cấu trúc dòng tiền

- How is the BeQ Vietnam VNX Superstar Index Different from the VNIndex and VN30?

- BeQ Vietnam VNX Superstar Index khác gì VNIndex và VN30?

- The Operating Mechanism of the BeQ Vietnam VNX Superstar Index

- Cơ chế vận hành của BeQ Vietnam VNX Superstar Index

- BeQ VNX Vietnam Top 10 Superstar Index

- BeQ VNX Vietnam Top 10 Superstar Index

- BeQ Vietnam VNX Superstar Index – Positioning Ahead of FTSE Emerging Market Capital Flows

- BeQ Vietnam VNX Superstar Index – Cách nhà đầu tư đi trước dòng tiền FTSE Emerging Market

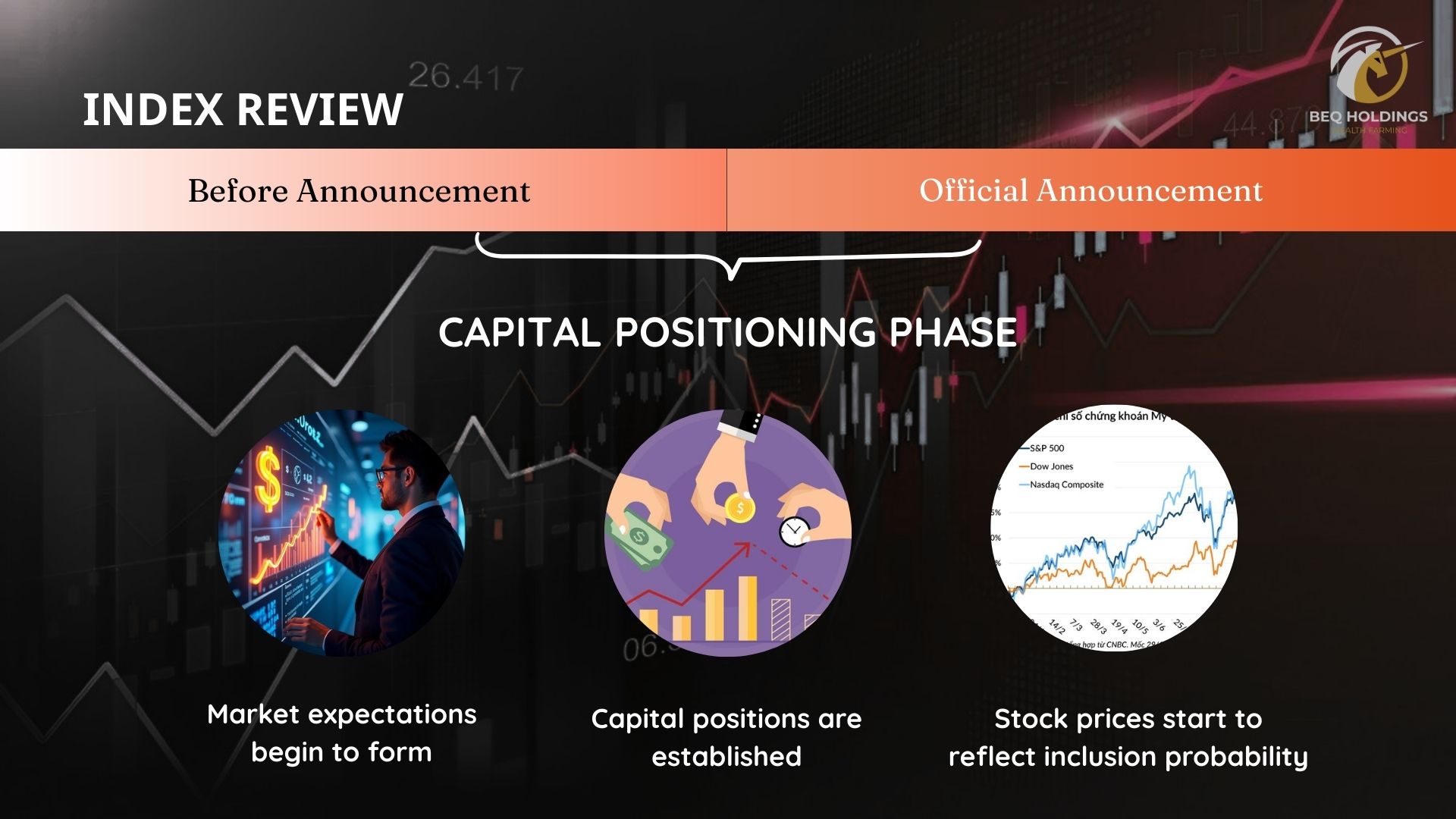

- Index Review – The Silent Restructuring Cycle That Drives Equity Prices

- Index Review – Chu kỳ tái cấu trúc thầm lặng chi phối giá cổ phiếu

- Why Do Stocks Rally Without News? An Index-Based Perspective

- Vì sao cổ phiếu tăng mạnh dù không có tin? Góc nhìn từ Index

- Index Funds – The True Foundation Behind ETFs and the Global Capital Allocation Mechanism

- Index Funds – Nền tảng thực sự đứng sau ETF và cơ chế phân bổ vốn toàn cầu

- What is an ETF? Why Global Capital Is Moving Away from Stock Picking and Toward ETFs

- ETF là gì? Vì sao dòng tiền toàn cầu không còn chọn cổ phiếu, mà chọn ETF

- Wealth Management in Vietnam’s Emerging Market: Why Long-Term Strategy Determines Investment Success

- Wealth Management tại Vietnam Emerging Market: Vì sao chiến lược dài hạn quyết định thành công trong đầu tư

- Do Financial Markets Really Move on News?

- Thị trường tài chính có thực sự vận hành theo tin tức?

- What is an Index? How Large Capital Flows Shape Financial Markets

- Index (chỉ số) là gì? Cách dòng tiền lớn vận hành thị trường tài chính

- Wealth Management in Emerging Markets

- Wealth Management Tại Thị Trường Mới Nổi

- Vietnam 2025: A New Center of Gravity in Global Capital Allocation

- Việt Nam 2025: Tâm Điểm Mới Của Chu Kỳ Phân Bổ Vốn Toàn Cầu

- When the Market Gained Only 60–70%, One Strategy Delivered +421% — Here’s Why

- Khi Thị Trường Chỉ Tăng 60–70%, Một Chiến Lược Đã TẠO RA +421% — Và Đây Là LÝ DO

- Thị Trường Mới Nổi Và Nghịch Lý Thua Lỗ Của Nhà Đầu Tư

- Emerging Markets and the Paradox of Investor Losses

- BEQ HOLDINGS HOSTS YEAR-END PARTY 2025 – ANNOUNCES AUM GROWTH VISION & ROADMAP TO INTERNATIONAL CAPITAL MARKETS

- BEQ HOLDINGS TỔ CHỨC TIỆC TẤT NIÊN 2025 – CÔNG BỐ TẦM NHÌN TĂNG TRƯỞNG AUM & LỘ TRÌNH VƯƠN RA THỊ TRƯỜNG VỐN QUỐC TẾ

- Cơ Hội Đầu Tư Tại Thị Trường Mới Nổi

- Investment Opportunities in Emerging Markets

- Decoding Index Reviews: A Strategy to Get Ahead of Trillions of Dollars in ETF Capital Flows

- Giải Mã Index Review: Chiến Lược Đón Đầu Dòng Tiền ETF Trị Giá Hàng Nghìn Tỷ USD

- Why Is Capital Flowing into Emerging Markets?

- Vì Sao Dòng Vốn Đổ Vào Thị Trường Mới Nổi?

- WealthTech – The Future of Wealth Management

- WealthTech – Tương Lai Quản Lý Gia Sản

- Thị Trường Mới Nổi: Giải Pháp Chiến Lược | BeQ Holdings

- Emerging Markets: Strategic Solutions | BeQ Holdings

- From Strategy to Cashflow: Decoding the Formula Behind This NFT Fund’s Success

- NFT NEC – THE NEXT-GEN INVESTMENT CERTIFICATE

- Bitcoin May Rise – But NFT BEQ Index Is What Helps Me Sleep at Night

- From Strategy to Cashflow: Decoding the Formula Behind This NFT Fund’s Success

- Wealth Farming Mechanism: Why You Can Earn Returns Without Monitoring the Market?

- The Delivery Rider and His First NFT: An Unexpected Turning Point

- From $100 → $121: NFT NEC is doing what savings accounts can’t

- Why Do The Rich Never “Save Money” Like The Poor?

- I used to believe: Work hard and I’ll be rich… Until I checked my bank account after 5 years of working.

- $1,000 – 82.55%/Year: An Investment Channel Not Made for the Loud Crowd

- The Rich Don’t Make Money Like You – They’re Buying What You’ve Never Thought Of

- Why “The Rich Don’t Work for Money” – And Neither Should You

- WARREN BUFFETT & HIS FINAL “NET CAST” MOVE

- Investment 2025: You Don’t Need Speed – You Need the Right Direction

- The Fox Mindset – Mastering Asset Control in Times of Chaos, and the Rise of NFT NEC

- Vietnam Quietly Redraws the Regional Economic Map

- Financial Massacre 2025: Currency War Ignites – The Final Chance to Save Yourself?

- FED Holds Rates, China Injects Liquidity, Vietnam Benefits – A 2025 Global Economic & Market Overview

- The Fed Holds Back, Apple Loses Steam, OpenAI Stirs Controversy – Where Are Smart Investors Moving Now?

- When the Market Shook – The Elites Already Knew and Quietly Grew Rich

- Japan, U.S. Treasury Bonds & The Silent Shock That’s Shaking Global Finance

- 60 DAYS LEFT: SAVE YOURSELF BEFORE THE GLOBAL FINANCIAL STORM HITS

- A New World Is Taking Shape – Where Will You Stand?

- WAKE UP – ARE YOU HOLDING CASH… OR HOLDING RISK?

- The Reason You’re Not Wealthy – It’s Not About Money

- 2025 Global Market Insight: Why Smart Capital Is Flowing Into Wealth Farming – And Why BeQ Holdings Is Leading the Transformation

- Market Crash or the Dawn of a New Era? – Only Visionary Investors See the Opportunity

- China Raises Retaliatory Tariffs on the U.S. – A New Window of Opportunity for Strategic Investors

- Why Do 90% of Investors Lose Money During a Crisis – and What Are the Other 10% Doing?

- [WHAT NO ONE TELLS YOU] In the Next 90 Days, Money Will Exit the U.S. – And This Is Why Vietnam Is Emerging as the New Global Hub

- [Weekly Economic Bulletin – April 14, 2025]

- Asian Stocks Surge After President Trump’s Surprise Decision – What Should Investors Do Now?

- Trump Raises Tariffs on China to 125% – Grants 90-Day Delay for 75 Countries, Including Vietnam

- [Expert Insight] Tariffs Through the Investor’s Lens: Opportunities Behind the Uncertainty

- [Weekly Insight] Opportunity Amid Crisis: When T.U.N.A. Becomes the New Map for Investors

- BEQ Group Foundation Announces GBP 30 Million Legal Guarantee – Reinforcing Financial Transparency and Commitment from the United Kingdom

- BEQ Holdings: Investment Opportunities Amid Monetary Policy Shifts

- BEQ Holdings: Investment Opportunities Amid Monetary Policy Shifts

- Analysis of Inflation and Deflation in China

- In-depth Analysis of Goldman Sachs’ Gold Demand Chart

- Terms of Service

- FAQs

- Contact

VI

VI EN

EN