- Giới Thiệu

- Sản Phẩm

- Bài Viết

- FTSE Upgrade 2026: ETF Inflows, Winning Stocks — Is Your Portfolio Positioned Correctly?

- Nâng hạng FTSE 2026: ETF Inflow, Winning Stocks & Danh mục của bạn đã đứng đúng vị trí?

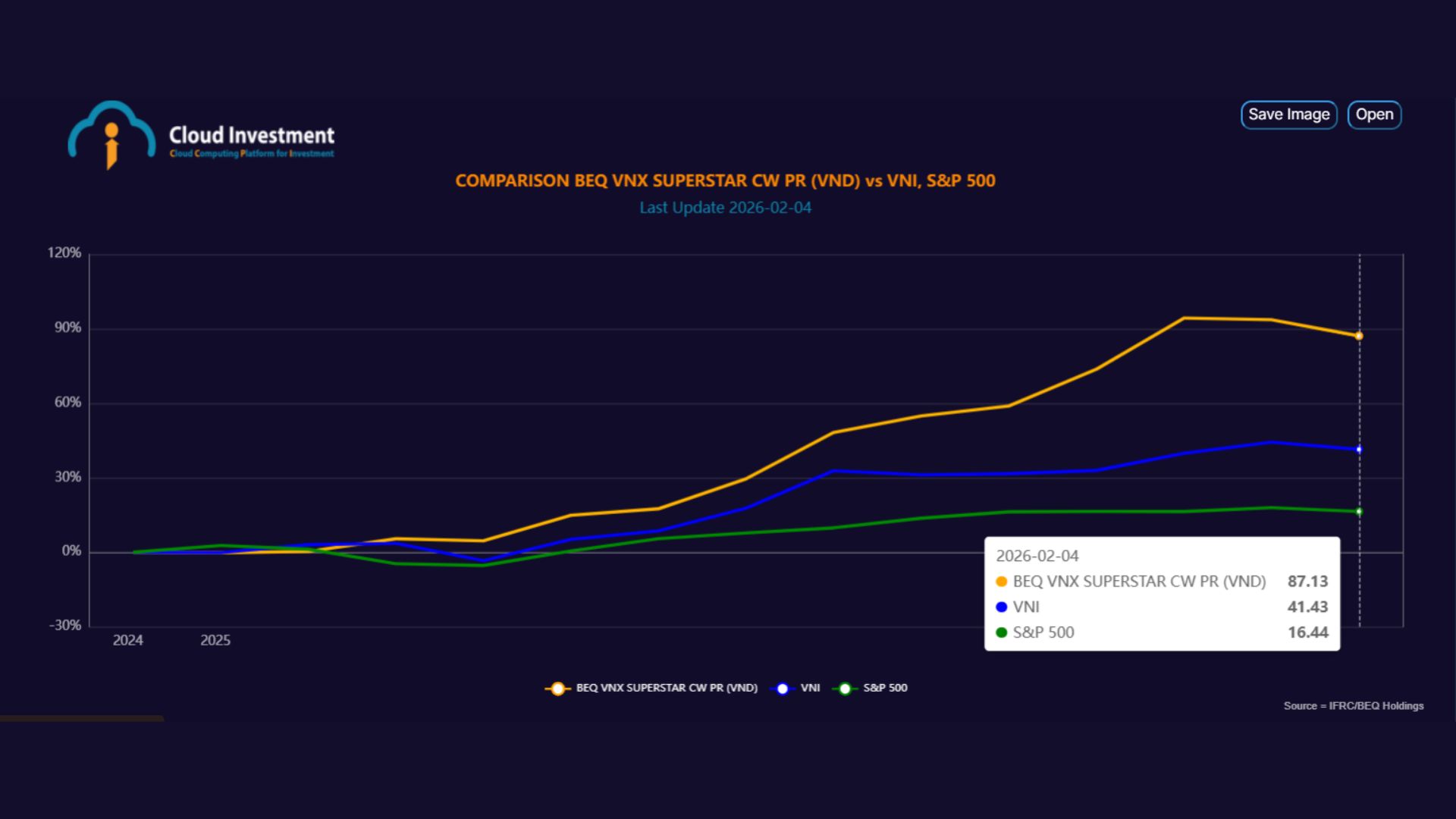

- BeQ Superstar Index: Why many investors still underperform despite correctly anticipating ETF flows

- BeQ Superstar Index: Vì sao nhiều nhà đầu tư vẫn thua dù đoán đúng dòng tiền ETF?

- BeQ Superstar Index: Why It Is Not Suitable for Every Investor

- BeQ Superstar Index: Vì sao không phải nhà đầu tư nào cũng nên theo đuổi?

- BeQ Superstar Index – A Safer Path as Global Capital Flows Shift

- BeQ Superstar Index: Lối tiếp cận an toàn khi FTSE Emerging Market tái cấu trúc dòng tiền

- How is the BeQ Vietnam VNX Superstar Index Different from the VNIndex and VN30?

- BeQ Vietnam VNX Superstar Index khác gì VNIndex và VN30?

- The Operating Mechanism of the BeQ Vietnam VNX Superstar Index

- Cơ chế vận hành của BeQ Vietnam VNX Superstar Index

- BeQ VNX Vietnam Top 10 Superstar Index

- BeQ VNX Vietnam Top 10 Superstar Index

- BeQ Vietnam VNX Superstar Index – Positioning Ahead of FTSE Emerging Market Capital Flows

- BeQ Vietnam VNX Superstar Index – Cách nhà đầu tư đi trước dòng tiền FTSE Emerging Market

- Index Review – The Silent Restructuring Cycle That Drives Equity Prices

- Index Review – Chu kỳ tái cấu trúc thầm lặng chi phối giá cổ phiếu

- Why Do Stocks Rally Without News? An Index-Based Perspective

- Vì sao cổ phiếu tăng mạnh dù không có tin? Góc nhìn từ Index

- Index Funds – The True Foundation Behind ETFs and the Global Capital Allocation Mechanism

- Index Funds – Nền tảng thực sự đứng sau ETF và cơ chế phân bổ vốn toàn cầu

- What is an ETF? Why Global Capital Is Moving Away from Stock Picking and Toward ETFs

- ETF là gì? Vì sao dòng tiền toàn cầu không còn chọn cổ phiếu, mà chọn ETF

- Wealth Management in Vietnam’s Emerging Market: Why Long-Term Strategy Determines Investment Success

- Wealth Management tại Vietnam Emerging Market: Vì sao chiến lược dài hạn quyết định thành công trong đầu tư

- Do Financial Markets Really Move on News?

- Thị trường tài chính có thực sự vận hành theo tin tức?

- What is an Index? How Large Capital Flows Shape Financial Markets

- Index (chỉ số) là gì? Cách dòng tiền lớn vận hành thị trường tài chính

- Wealth Management in Emerging Markets

- Wealth Management Tại Thị Trường Mới Nổi

- Vietnam 2025: A New Center of Gravity in Global Capital Allocation

- Việt Nam 2025: Tâm Điểm Mới Của Chu Kỳ Phân Bổ Vốn Toàn Cầu

- When the Market Gained Only 60–70%, One Strategy Delivered +421% — Here’s Why

- Khi Thị Trường Chỉ Tăng 60–70%, Một Chiến Lược Đã TẠO RA +421% — Và Đây Là LÝ DO

- Thị Trường Mới Nổi Và Nghịch Lý Thua Lỗ Của Nhà Đầu Tư

- Emerging Markets and the Paradox of Investor Losses

- BEQ HOLDINGS HOSTS YEAR-END PARTY 2025 – ANNOUNCES AUM GROWTH VISION & ROADMAP TO INTERNATIONAL CAPITAL MARKETS

- BEQ HOLDINGS TỔ CHỨC TIỆC TẤT NIÊN 2025 – CÔNG BỐ TẦM NHÌN TĂNG TRƯỞNG AUM & LỘ TRÌNH VƯƠN RA THỊ TRƯỜNG VỐN QUỐC TẾ

- Cơ Hội Đầu Tư Tại Thị Trường Mới Nổi

- Investment Opportunities in Emerging Markets

- Decoding Index Reviews: A Strategy to Get Ahead of Trillions of Dollars in ETF Capital Flows

- Giải Mã Index Review: Chiến Lược Đón Đầu Dòng Tiền ETF Trị Giá Hàng Nghìn Tỷ USD

- Why Is Capital Flowing into Emerging Markets?

- Vì Sao Dòng Vốn Đổ Vào Thị Trường Mới Nổi?

- WealthTech – The Future of Wealth Management

- WealthTech – Tương Lai Quản Lý Gia Sản

- Thị Trường Mới Nổi: Giải Pháp Chiến Lược | BeQ Holdings

- Emerging Markets: Strategic Solutions | BeQ Holdings

- From Strategy to Cashflow: Decoding the Formula Behind This NFT Fund’s Success

- NFT NEC – CHỨNG CHỈ QUỸ THẾ HỆ MỚI

- Bitcoin có thể tăng – nhưng NFT BEQ Index mới là thứ giúp tôi ngủ ngon mỗi đêm

- From Strategy to Cashflow: Decoding the Formula Behind This NFT Fund’s Success

- Cơ chế Wealth Farming: Tại sao bạn có thể nhận lãi mà không cần canh thị trường?

- Anh shipper và chiếc NFT đầu tiên: Một bước ngoặt bất ngờ

- From $100 → $121: NFT NEC is doing what savings accounts can’t

- Why Do The Rich Never “Save Money” Like The Poor?

- I used to believe: Work hard and I’ll be rich… Until I checked my bank account after 5 years of working.

- 1.000 USD – 82,55%/năm: Một kênh đầu tư không dành cho người thích sự ồn ào

- Người Giàu Không Kiếm Tiền Như Bạn – Họ Đang Mua Thứ Bạn Chưa Từng Nghĩ Tới

- Vì Sao “Người Giàu Không Sống Dựa Vào Công Việc” – Và Bạn Cũng Không Nên

- WARREN BUFFETT & VÁN CỜ CUỐI CÙNG

- Đầu Tư 2025: Không Cần Nhanh – Chỉ Cần Đúng Hướng

- Tư Duy Cáo Già – Nghệ Thuật Kiểm Soát Tài Sản Trong Thời Loạn Và Cơ Hội Mới Với NFT NEC

- Việt Nam Âm Thầm Tái Định Vị Trên Bản Đồ Kinh Tế Toàn Cầu

- Thảm Sát Tài Chính 2025: Bẫy Tỷ Giá Đã Kích Hoạt – Cơ Hội Cuối Cùng Để Tự Cứu Mình?

- FED Giữ Lãi Suất, Trung Quốc Bơm Tiền, Việt Nam Hưởng Lợi – Toàn Cảnh Kinh Tế & Thị Trường 2025

- Fed Không Bơm Tiền, Apple Mất Lửa, OpenAI Gây Sốc – Nhà Đầu Tư Thông Minh Đang Chuyển Dòng Tiền Đi Đâu?

- Khi thị trường rung chuyển – Giới tinh anh đã biết trước và âm thầm giàu lên

- Nhật Bản, Trái Phiếu Mỹ và Cơn Địa Chấn Thầm Lặng Làm Rung Chuyển Cả Hệ Thống Tài Chính Toàn Cầu

- CÒN 60 NGÀY NỮA: TỰ CỨU MÌNH TRƯỚC SÓNG KHỦNG HOẢNG TÀI CHÍNH TOÀN CẦU

- Một Thế Giới Mới Đang Thành Hình - Bạn Đang Ở Đâu Trong Cuộc Chơi Này?

- THỨC DẬY ĐI – BẠN ĐANG CẦM TIỀN… HAY CẦM RỦI RO?

- Lý Do Bạn Chưa Giàu – Không Phải Vì Thiếu Tiền

- Toàn cảnh thị trường 2025: Vì sao dòng vốn thông minh đang đổ vào Wealth Farming – và vì sao BeQ Holdings đang dẫn đầu làn sóng này

- Thị Trường Sụp Đổ Hay Bắt Đầu Một Kỷ Nguyên Mới? – Chỉ Những Nhà Đầu Tư Có Tầm Mới Nhìn Thấy Cơ Hội

- Trung Quốc Tăng Thuế Trả Đũa Mỹ – Cơ Hội Mới Mở Ra Cho Nhà Đầu Tư Biết Đón Sóng

- Tại Sao 90% Nhà Đầu Tư Thua Lỗ Trong Khủng Hoảng – Và 10% Còn Lại Đang Làm Gì?

- [ĐIỀU KHÔNG AI NÓI RA] 90 Ngày Tới, Tiền Sẽ Rời Bỏ Mỹ – Và Đây Là Lý Do Việt Nam Sẽ Trở Thành Trung Tâm Mới Của Thế Giới

- [Bản Tin Kinh Tế 14/04/2025]

- Asian Stocks Surge After President Trump’s Surprise Decision – What Should Investors Do Now?

- Trump Tăng Thuế Lên 125% Với Trung Quốc – Tạm Hoãn 90 Ngày Với 75 Quốc Gia, Bao Gồm Việt Nam

- [Góc Nhìn Chuyên Gia] Thuế Quan Dưới Góc Nhìn Nhà Đầu Tư: Cơ Hội Ẩn Sau Sự Lo Lắng

- [Phân Tích Tuần] Cơ Hội Trong Khủng Hoảng: Khi T.U.N.A. Trở Thành Bản Đồ Định Hướng Mới Cho Nhà Đầu Tư

- BEQ Group Foundation Công Bố Khoản Bảo Chứng 30 Triệu Bảng Anh – Cam Kết Pháp Lý và Minh Bạch Tài Chính Từ Vương Quốc Anh

- BEQ Holdings: Cơ Hội Đầu Tư Trong Bối Cảnh Chuyển Dịch Chính Sách Tiền Tệ

- BEQ Holdings: Cơ Hội Đầu Tư Trong Bối Cảnh Chuyển Dịch Chính Sách Tiền Tệ

- Phân tích tình hình lạm phát và giảm phát tại Trung Quốc

- In-depth Analysis of Goldman Sachs’ Gold Demand Chart

- Điều Khoản Dịch Vụ

- Câu Hỏi Thường Gặp

- Contact

VI

VI EN

EN